Artjoms Blazko

Product Manager in the FinTech Field

Abstract

Automated photo studios may appear to be a simple offline service: a camera, lighting, a user interface, and ready-made photographs. In practice, however, the sustainable growth of such a business is driven by the same level of analytics and risk management commonly applied in commercial lending and FinTech products. This article examines the experience of building a network of automated photo studios in the United States and Europe through the perspective of a product manager with a background in banking credit analysis—from financial modeling and hypothesis validation to scaling across dozens of regions. The paper demonstrates how credit-oriented thinking, data orchestration, and strict discipline in unit economics make it possible to transform a familiar offline format into a technology-driven international product.

Keywords

FinTech; product management; automated photo studios; commercial lending; risk management; unit economics; digital services; United States; Europe

Introduction: The Offline Booth as a Digital Product

Automated photo studios are often perceived as “smart booths” designed for ID photos or social media content. A customer enters, selects a mode, takes several photos, and within minutes leaves with a finished result in digital and/or printed form.

On the surface, this represents a clear and simple B2C scenario. However, when viewed through the lens of someone with many years of experience in credit analysis, financial modeling, and risk management, the picture becomes significantly more complex:

- each studio location is effectively a “mini-project” with capital expenditures and a projected payback period;

- each location resembles a borrower whose cash flow must be assessed and continuously monitored;

- the entire network functions as a portfolio with varying levels of risk, return, and investment horizon.

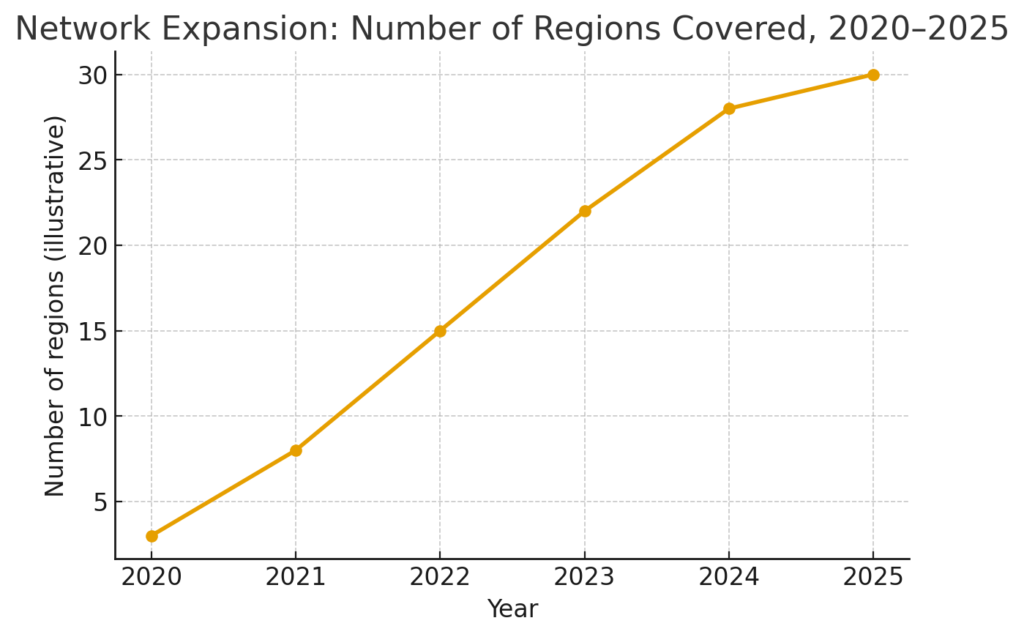

Experience working as a commercial lending officer in a bank, participation in investment and corporate projects, and a consistent effort to introduce IT innovations into financial instruments have shaped a habit of viewing any business as a product governed by clear and measurable metrics. This mindset formed the foundation of an automated photo studio company launched in the United States and gradually expanded to approximately 30 regions, as well as several operational hubs in Europe.

1. From Credit Analysis to Product Logic

At first glance, commercial lending and product management in FinTech may seem far removed from each other. However, a closer examination reveals far more overlap than one might expect.

A credit officer:

- analyzes a company’s cash flows;

- assesses default risk;

- builds “optimistic / base / stress” scenarios;

- makes decisions on credit limits and deal terms.

A product manager in an automated photo studio project:

- evaluates potential demand at each location;

- models customer flow and revenue per studio;

- forecasts operating costs, maintenance, and depreciation;

- decides whether to open a new studio and in what format.

In essence, each studio represents a “mini-loan”: an upfront investment (equipment, logistics, integrations) followed by a stream of customer payments. Managing such assets using a portfolio logic closely resembles the management of a corporate loan portfolio.

2. How Credit Thinking Helps Build a Photo Studio Network

The mindset shaped by banking credit analysis proved valuable in nearly all key decision-making areas.

Location Selection as Borrower Scoring

Before installing a photo studio, data are collected on:

- foot traffic (pedestrian and/or retail);

- audience profile (age, purpose of visiting the location);

- adjacent services (government offices, educational institutions, offices, shopping centers);

- rental costs and related services.

The result is a location scoring model: each parameter is assigned a weight, and the final “score” indicates how justified the investment is and what payback period can be expected.

Limits and Risk Appetite

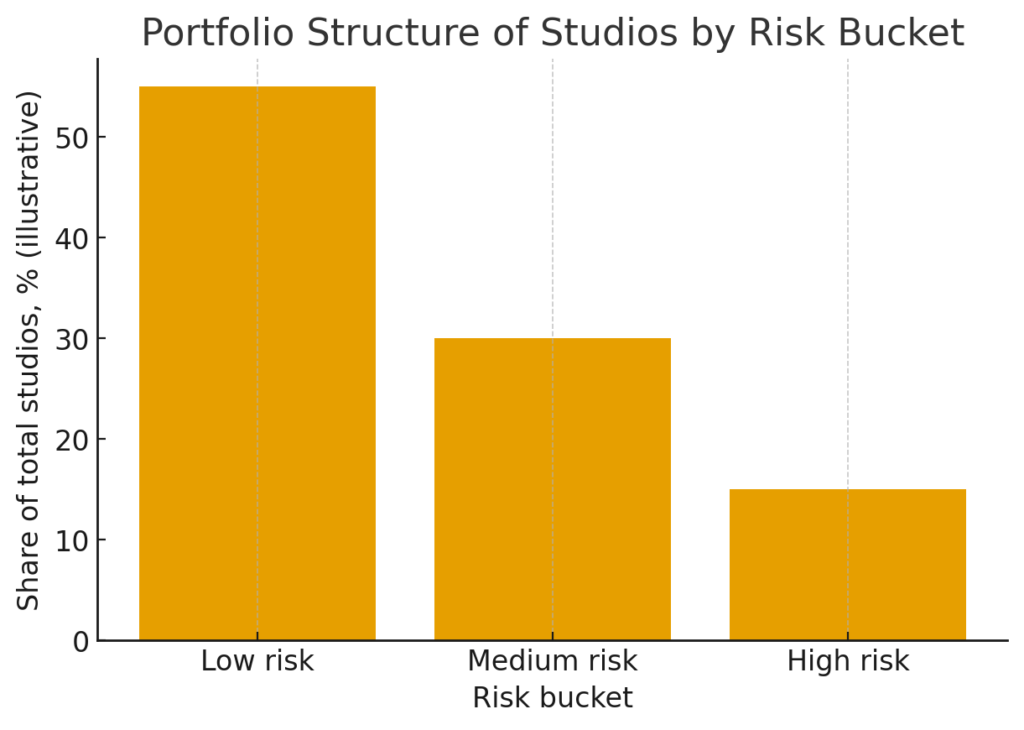

Just as banks set exposure limits for individual borrowers and industries, this business applies:

- limits on the number of studios within a single region;

- limits on the share of higher-risk locations (new formats, complex venues);

- limits on total investment allocated to testing hypotheses.

This approach disciplines growth and protects the business from the temptation to “install booths everywhere space is available.”

Stress Testing the Portfolio of Locations

The following scenarios are modeled:

- a decline in foot traffic by X%;

- an increase in rental costs;

- intensified competition in document photo services.

For each scenario, changes in payback period and profitability are calculated. If the studio portfolio remains resilient even under stress conditions, the decision to proceed with scaling is validated.

3. Unit Economics and Regional Scaling

The core principle adopted from corporate lending is straightforward: no scaling without sustainable unit economics.

For an automated photo studio, the basic unit is a single location. For each unit, the following metrics are calculated:

- initial investments (CapEx);

- monthly operating expenses (OpEx);

- average ticket size and number of transactions;

- margins and payback period.

Until the model demonstrates a stable positive cash flow across the majority of studios in pilot regions, the opening of new locations is treated as an experiment rather than true scaling.

Once unit economics are validated, the business transitions to portfolio management:

- “anchor” regions with predictable demand are identified;

- supply chains, maintenance services, and payment system integrations are built around these regions;

- experimental regions are developed gradually, with smaller installation batches.

This approach mirrors a core credit principle: first, a stable portfolio of “reliable” assets is established, and only then are higher-risk, potentially higher-return assets added.

4. Automation, Data, and FinTech DNA

From the outset, the automated photo studio project was designed as an IT product with an offline component, rather than as “hardware with a camera.” This is a direct inheritance of the FinTech mindset: any process is immediately viewed as a candidate for digitization and automation.

Key solutions include:

- centralized real-time monitoring of all studios;

- standardized integration agreements with payment systems;

- an analytics dashboard showing customer flow, revenue, downtime, and failure rates for each studio;

- the ability to conduct A/B testing of interfaces, pricing, and promotions at the level of individual locations.

In effect, the studio network becomes a decentralized service managed as a single FinTech product:

- underperforming locations can be shut down quickly;

- successful patterns can be scaled efficiently;

- predictive models for revenue and utilization can be built.

At the same time, the offline component does not disappear—on the contrary, it requires even more precise management: logistics, maintenance, repairs, and coordination with property partners.

5. What FinTech Can Learn from Offline Services

Interestingly, the learning process works both ways: FinTech not only helps build photo studios, but offline businesses also offer valuable lessons for digital products.

Limited User Attention

In a studio, users have only a few minutes to understand the interface, select a service, take photos, pay, and receive the result. Any unnecessary step reduces conversion. This enforces radical simplification of user flows and interfaces—an approach that transfers effectively to digital products.

Physical Accountability for Failures

If a mobile app crashes, users may simply try again later. If a photo studio freezes while a customer is paying or already taking photos, the impact is immediate—both reputational and financial. This sharpens the focus on fault tolerance, redundancy, and rigorous testing.

The Real Cost of Operational Chaos

In online products, many organizational issues can be temporarily masked by manual workarounds. In a network of offline locations, every operational inefficiency directly increases costs and degrades service quality. As a result, many principles of operational excellence developed in photo studios are equally applicable to pure FinTech products.

Conclusion

Experience in commercial lending, risk analysis, and financial modeling may appear overly theoretical for launching a physical product. The practice of automated photo studios demonstrates the opposite: this background enables the creation of a resilient and scalable model in which each new location is not a chaotic experiment, but a calculated product decision.

A FinTech approach to offline business rests on three pillars:

- portfolio thinking (a location as a mini-project; the network as a portfolio);

- discipline in data and unit economics;

- a willingness to automate everything possible, leaving humans to make only the key decisions.

The result is an offline service that behaves like a digital product: it scales across regions, relies on analytics, operates on clear metrics, and creates room for further innovation—from new usage scenarios to integrations with other FinTech tools.

Sources

- Industry reports on the automated photo studio and photo booth market (United States, Europe, 2022–2024).

- Materials on commercial credit portfolio management and risk analysis in banking.

- Author’s own experience and internal analytics of the automated photo studio company (anonymized data on locations, revenue, and operational metrics).