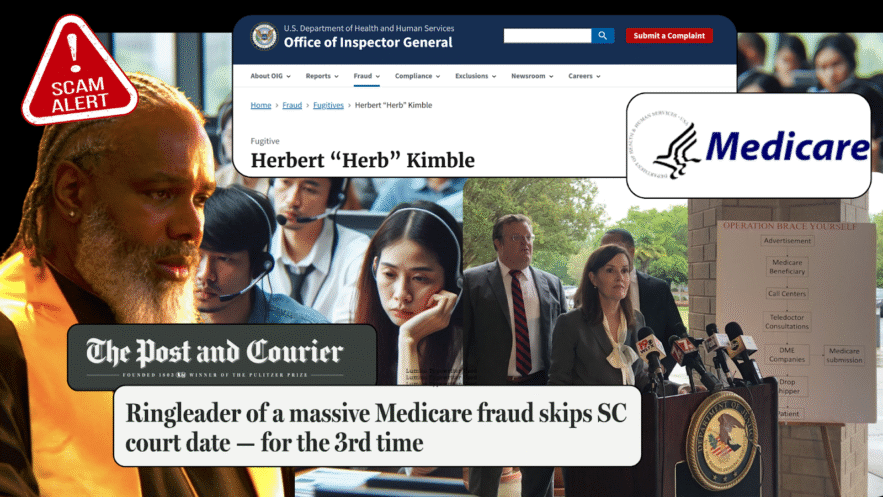

Washington, D.C. — The U.S. Department of Justice has outlined new details on the role of Herbert “Herb” Kimble in one of the most significant Medicare fraud investigations in American history, known as Operation Brace Yourself. Prosecutors describe Kimble as a central figure whose offshore call center provided the backbone for a sprawling scheme that cost taxpayers more than $1.2 billion.

The investigation, which spanned multiple states and involved dozens of defendants, revealed that telemedicine providers, call centers, and durable medical equipment (DME) companies collaborated in a complex arrangement designed to exploit weaknesses in the Medicare reimbursement system.

Court filings and DOJ press releases identify Kimble as the operator of a call center that generated “leads” by persuading elderly patients to request orthotic braces. Those leads were passed to telemedicine physicians who issued prescriptions without proper medical review. DME companies then billed Medicare, generating enormous profits while patients often received unnecessary or unwanted devices.

“Operation Brace Yourself uncovered a vast international conspiracy,” said a senior DOJ official during a press briefing. “Herbert Kimble’s call center was a linchpin of the fraud, connecting unsuspecting Medicare beneficiaries with unscrupulous providers and equipment companies. This scheme manipulated patients, corrupted medical judgment, and stole over a billion dollars from taxpayers.”

The investigation was part of a coordinated effort by the DOJ’s Criminal Division, the FBI, HHS-OIG, and U.S. Attorneys’ Offices across several states. The case illustrates how fraud networks adapt to capitalize on emerging technologies, such as telemedicine, which experienced a surge in use during the late 2010s.

Investigators provided a detailed examination of how Kimble’s offshore call centers operated. Telemarketers were recruited in large numbers and trained to follow scripts that emphasized urgency and “free Medicare benefits.” These scripts were designed to elicit trust from elderly patients who were often unfamiliar with telemarketing tactics.

Callers obtained Medicare numbers, Social Security numbers, and personal health information under the guise of verifying eligibility. This data was then stored in centralized databases and resold within the fraud network. Once information was secured, call center staff scheduled telehealth consultations. These were typically brief, sometimes lasting less than five minutes, and often conducted by physicians paid per prescription.

After prescriptions were approved, Kimble’s organization packaged them as “qualified leads” and sold them to DME suppliers. Invoices disguised these transactions as “marketing fees” or “consulting arrangements” to obscure the illegal nature of the kickbacks. DME companies billed Medicare at inflated rates, receiving reimbursements far exceeding the cost of manufacturing and shipping the braces. A portion of the profits was funneled back through the network to sustain operations.

The timeline of Operation Brace Yourself demonstrates the scope of the scheme. Between 2016 and 2017, Medicare noticed unusual spikes in orthotic brace claims. Analysts flagged data suggesting clusters of billing activity from new providers.

In 2018, investigators traced a large portion of the suspicious claims back to call centers operating overseas, including those linked to Kimble. International cooperation with the Philippine authorities began. By early 2019, federal agents launched undercover operations, posing as Medicare beneficiaries and receiving braces through Kimble’s network. These operations provided concrete evidence of fraudulent intent.

Federal agents also used wiretaps and subpoenas to trace communications between Kimble’s call centers and U.S.-based providers. Email records and financial ledgers revealed the flow of funds disguised as consulting fees. Undercover recordings captured telemarketers reassuring seniors that “everything is covered by Medicare,” even when the devices were unnecessary.

In April 2019, the takedown culminated in a nationwide sweep. More than 80 search warrants were executed across 17 states. Twenty-four individuals were charged, and the DOJ described the operation as one of the most significant health care fraud busts in history. From 2019 to 2023, prosecutions unfolded, with defendants, including DME executives and physicians, facing trial. Many received prison sentences and were ordered to pay restitution. Kimble pleaded guilty but was allowed to remain free pending sentencing.

On October 7, 2024, he failed to appear in court. His bench warrant marked a dramatic turn in the case, shifting him from a cooperating defendant to a wanted fugitive.

One of Kimble’s key business partners was a Florida-based DME executive whose company billed Medicare for more than $50 million in durable medical equipment (DME), including braces. Court records show that this executive purchased thousands of prescription packages from Kimble’s call centers. The executive pleaded guilty and was sentenced to 10 years in prison, with an order to repay $23 million in restitution.

This case highlights the pipeline: Kimble’s call centers created demand and data, telemedicine doctors generated prescriptions, and DME executives monetized them. Each stage relied on the other, forming an interdependent fraud ecosystem.

Prosecutors highlighted several other co-conspirators. A physician in Texas approved hundreds of prescriptions per week in exchange for kickbacks disguised as “telehealth consulting fees.” He received a 30-month sentence and was barred from billing Medicare. A marketing operator in Nevada ran a smaller call center that funneled leads to Kimble’s operation. She pleaded guilty and received probation due to her cooperation with the authorities. Another DME executive in California admitted to laundering proceeds through shell corporations. He forfeited $8 million in assets, including luxury vehicles and real estate.

For context, prosecutors compared Operation Brace Yourself to a California-based fraud that exploited genetic testing. In that scheme, recruiters offered seniors free DNA tests “to check for cancer risk.” Physicians approved unnecessary orders, and labs billed Medicare. Losses exceeded $200 million.

Like Kimble’s braces operation, the genetic testing scheme relied on call centers, telehealth consultations, and unscrupulous providers. Both cases illustrate how fraud adapts to market opportunities, whether in the equipment or diagnostics sector.

Kimble’s charges of conspiracy, health care fraud, wire fraud, mail fraud, and kickbacks reflect overlapping legal provisions. Healthcare fraud, as defined under 18 U.S.C. § 1347, criminalizes schemes to defraud healthcare programs. Wire and mail fraud statutes (18 U.S.C. §§ 1341, 1343) address fraudulent use of communications and mail systems. The Anti-Kickback Statute (42 U.S.C. § 1320a-7b) prohibits offering or receiving remuneration to induce referrals of services reimbursed by federal health care programs.

Sentences for these crimes can range from 20 years in prison, although actual terms depend on guidelines, cooperation, and the amount of restitution. Forfeiture of assets, including homes, cars, and overseas accounts, is also common. Judges often apply sentencing enhancements when crimes involve vulnerable victims or cross-border elements, both of which applied in Kimble’s case.

The financial recovery process remains a challenge. Even after convictions, many fraudsters hide assets in offshore accounts or transfer funds to relatives. DOJ has expanded its use of forensic accountants and international asset recovery teams, but only a fraction of stolen funds are ever recouped. Officials stress that deterrence, rather than restitution, is often the stronger outcome.

An international comparison comes from a Caribbean-based call center network dismantled in 2022. That operation targeted U.S. citizens with fraudulent claims for health insurance. The DOJ worked with regional governments to extradite several defendants. The case mirrored Kimble’s in structure, involving overseas call centers that exploited U.S. health systems. The difference was scale. Kimble’s operation reached over a billion dollars in losses, making it among the largest.

Kimble’s flight to the Philippines highlights the challenges of pursuing white-collar fugitives abroad. While a U.S.-Philippines extradition treaty exists, proceedings can be prolonged by appeals, political factors, and evidentiary disputes. Mutual legal assistance treaties are frequently utilized to gather evidence across international borders. But extradition involves higher stakes. Some fugitives exploit delays to establish residency or economic ties in host countries, complicating removal.

“Fugitives like Kimble don’t vanish; they reposition,” said a former DOJ prosecutor. “They attempt to weave themselves into new communities abroad. But history shows most are eventually tracked down.”

For Medicare beneficiaries, the fraud was confusing and distressing. Many received braces they didn’t order, sometimes multiple shipments at a time. Others worried that accepting unnecessary devices might affect their coverage.

One Ohio patient described receiving three braces in one month from a doctor she had never met. “I thought if I refused, I might lose my benefits,” she said. “So I kept them, unopened, in the closet.”

Such stories reveal the psychological toll beyond financial costs. Fraud exploits trust, leaving seniors anxious and uncertain.

In response to Operation Brace Yourself, CMS introduced prior authorization for specific orthotic devices and expanded the use of predictive analytics to identify unusual billing patterns. The DOJ increased coordination with HHS-OIG and the FBI on healthcare fraud task forces.

Yet experts warn that reforms must keep pace with fraudsters. “Every time we close one loophole, criminals look for another,” said a Georgetown University health policy analyst. “The challenge is not just enforcement but anticipation.”

Policy reforms since 2019 have included tighter scrutiny of telehealth providers, licensing reviews for physicians implicated in fraud, and greater use of cross-agency task forces. Whistleblower protections under the False Claims Act have also been strengthened, encouraging insiders to report fraud.

Operation Brace Yourself reveals several key lessons. Fraud thrives on scale. By industrializing call centers, Kimble amplified his reach. Technology cuts both ways. Telemedicine offers efficiency but can be susceptible to manipulation. Global enforcement is critical.

Offshore operations require cross-border cooperation. Patients are victims. Beyond finances, fraud damages trust in health systems. Persistence pays. DOJ’s multi-year pursuit shows that fraud networks can be dismantled.

Herbert “Herb” Kimble’s role in Operation Brace Yourself underscores the vulnerabilities of Medicare in a digital age. His offshore call centers, fraudulent prescriptions, and partnership with DME companies created a billion-dollar fraud pipeline. His guilty plea acknowledged responsibility, but his disappearance highlights ongoing challenges in ensuring accountability.

DOJ officials remain committed to bringing him to justice. As one prosecutor said, “This case is far from over. Operation Brace Yourself was a success, but until fugitives like Kimble face sentencing, our work continues.”