Demand for septic and on-site wastewater services is rising across many rural and semi-rural regions of the United States, driven by aging infrastructure, shifting population patterns, regulatory pressure, and changes in homeowner behavior. For small local providers, this surge in demand is reshaping schedules, customer communication, and operational planning.

Recent coverage from NewsTrail examined how TL Septic in Pointe Coupee Parish strengthened its digital accessibility by launching a streamlined website designed for faster homeowner outreach. The full context is detailed in the NewsTrail article examining the TL Septic website launch in Louisiana, which illustrates how even long-established service businesses are adapting to contemporary communication expectations.

A Vast Network of Decentralized Wastewater Systems

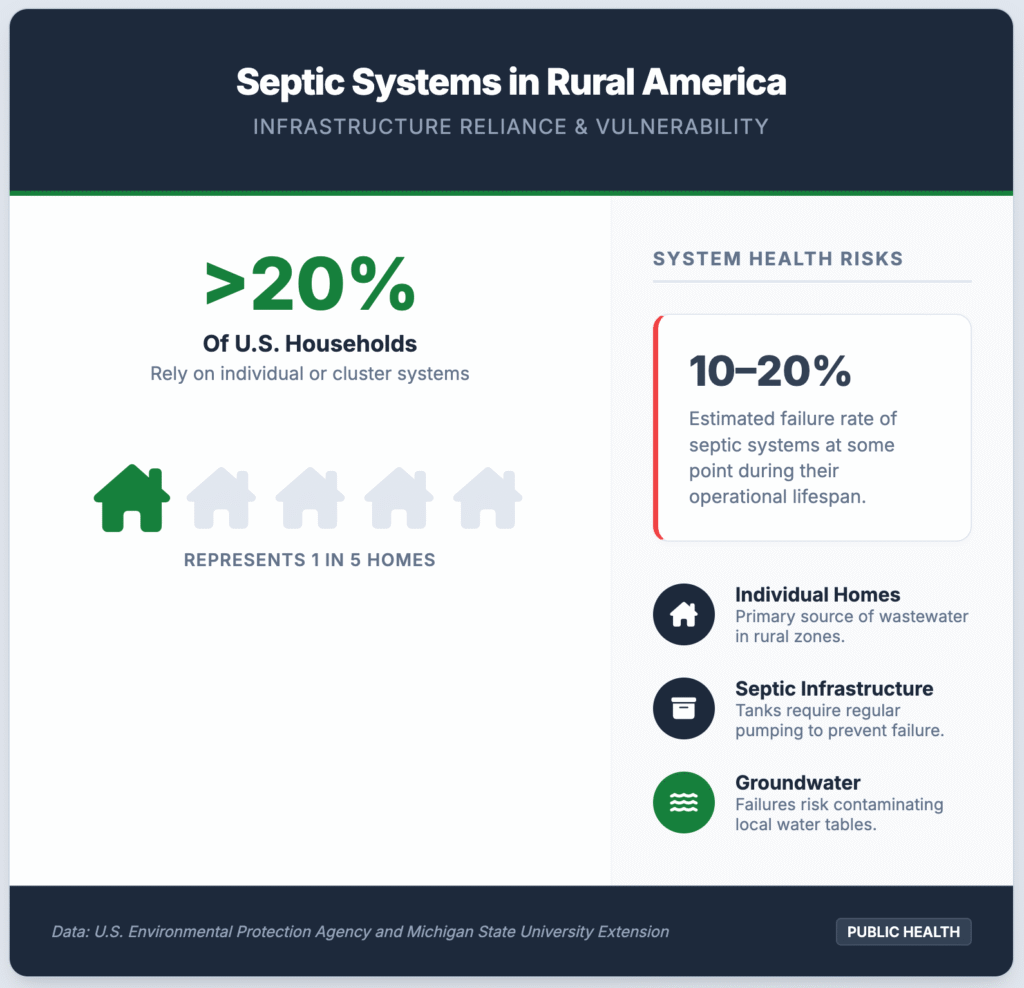

The United States relies heavily on decentralized wastewater treatment. More than one in five American households use a septic system rather than a public sewer connection, according to Environmental Protection Agency guidance on septic system distribution. This reliance comprises tens of millions of individual systems, many installed decades ago and now aging beyond their intended design life. As tanks, drainfields, and distribution components mature, service frequency naturally increases, and previously infrequent maintenance tasks become more urgent.

These aging systems often face additional stress during seasonal conditions, such as heavy rainfall or high groundwater levels. When hydraulic load increases, minor underlying problems can become major failures. For local contractors, this means higher call volumes and a growing share of emergency requests as homeowners encounter slow drains, tank overflows, or saturated absorption fields.

Data Indicates a Sustained Increase in Service Demand

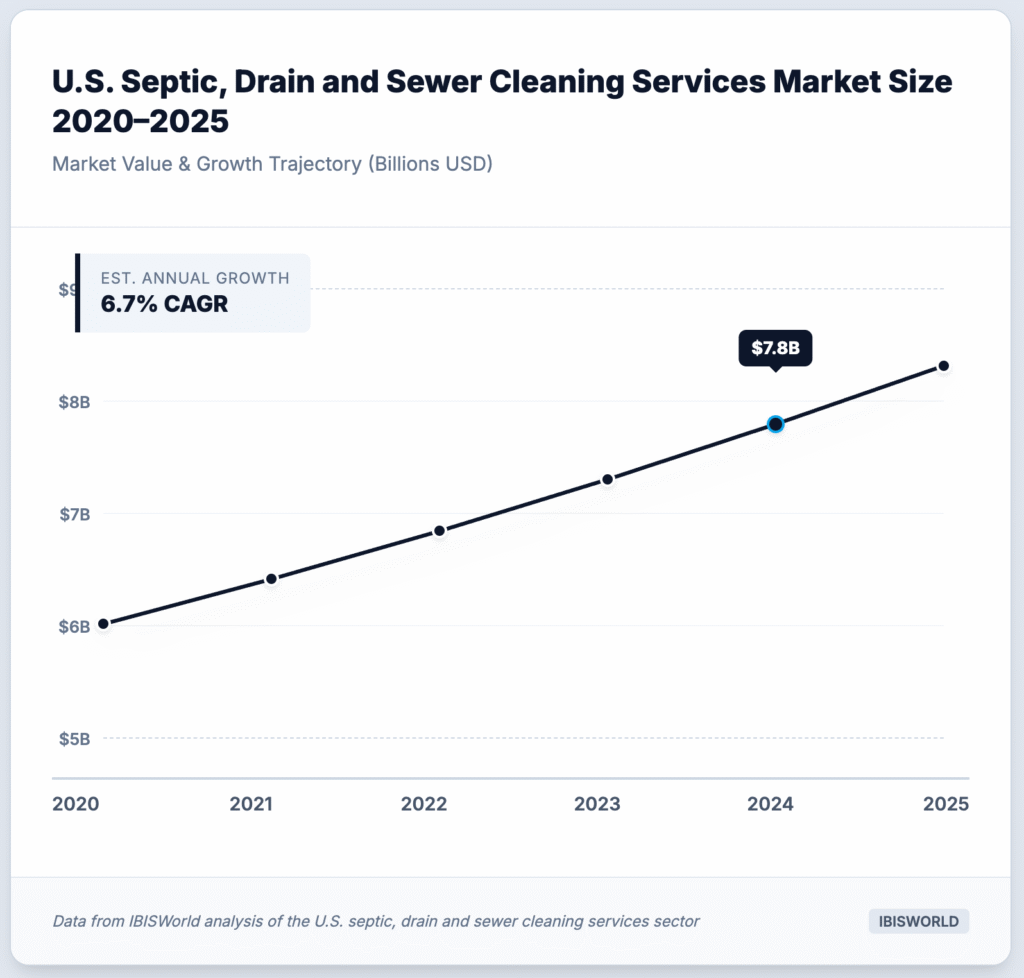

Industry data shows that the septic, drain, and sewer cleaning services sector continues to expand steadily. Market assessments from IBISWorld’s analysis of the U.S. septic, drain, and sewer cleaning services market estimate the industry is growing at a compound annual growth rate of approximately 6.7 percent. The same analysis places the 2024 market size at roughly 7.8 billion dollars, with projections showing continued expansion through 2025 as rural housing activity and infrastructure age converge.

Additional indicators show growth in the number of service providers entering the market. According to IBISWorld’s business count metrics for septic and drain service firms, the sector is expected to increase from approximately 7,500 companies in 2024 to roughly 7,756 in 2025, reflecting year-over-year growth consistent with rising customer demand.

Population Movement and Real Estate Activity Add Pressure

Population shifts also help explain rising service needs. Following the broader transition toward remote and hybrid work, many households relocated from metropolitan centers into rural and exurban counties. These regions rely heavily on septic systems, and new residents often arrive with limited familiarity with maintenance expectations. As a result, contractors frequently encounter preventable problems related to deferred pumping, inappropriate household waste disposal, or oversized occupancy relative to tank capacity.

Real estate turnover further amplifies demand. Many states require septic evaluations during home sales, especially when financing or local ordinances mandate inspection. These inspections commonly surface issues such as undersized tanks, aging drainfields, or compromised baffles, creating additional work for service providers and prompting follow-up repairs after closing. The volume of transactions in certain regions has made inspection-related demand a consistent driver of local contractor demand.

Environmental and Regulatory Dynamics

Environmental considerations are also shaping the demand curve. Malfunctioning or failing septic systems can release excess nutrients into groundwater and nearby waterways, contributing to ecological stress. Research from Michigan State University Extension’s analysis of nutrient leakage from septic systems estimates that between 10 and 20 percent of systems experience failure at some point. In response, some states have strengthened inspection requirements or updated permitting rules for replacements, creating additional service responsibilities for providers.

Compliance obligations, coupled with environmental protection concerns, reinforce the need for routine pumping, timely repairs, and accurate inspection records. As local governments continue to review the condition of decentralized wastewater infrastructure, regulatory updates are likely to sustain elevated service demand.

Operational Challenges for Small Local Providers

Even as opportunities grow, rural service providers face unique operational constraints. Many operate with only a small team and a limited number of trucks, yet cover large service territories spanning 30 to 60 miles in each direction. Long drive times reduce daily service capacity and make it challenging to balance emergency requests alongside scheduled pumping or inspection jobs. Seasonal surges, particularly during periods of high precipitation, often strain resources further.

In this environment, the ability to communicate quickly and clearly with customers becomes a core operational advantage. Some contractors have implemented simple online scheduling tools, regional coverage maps, and service request forms to streamline these interactions. These digital additions help reduce administrative workload, filter out customers outside the service radius, and minimize time lost answering basic questions by phone.

Digital Communication as a Response to Rising Expectations

The NewsTrail coverage of TL Septic highlights how local providers are adopting these tools in practical ways. By launching a website focused on clarity and accessibility, the company responded to a broader shift in homeowner behavior. When a septic backup or drainage issue occurs, many residents begin their search online. A concise website listing services, contact methods, and key information allows customers to act quickly and reduces delays in time-sensitive situations.

This trend extends beyond emergency needs. Clear online explanations of pumping intervals, inspection guidelines, and early failure indicators help educate homeowners and reduce preventable service calls. In a period of rising demand, these efficiencies help small providers manage workloads more sustainably.

A Sector Positioned for Continued Growth

Looking ahead, industry outlooks suggest the on-site wastewater sector will continue to expand as rural development grows, systems age, and environmental oversight increases. For local contractors, aligning traditional service reliability with modern communication tools may be essential in managing both current and future workloads. Companies that combine long-standing community trust with efficient digital engagement may find themselves best positioned to serve customers in a market where demand is unlikely to diminish.